Discover how Myra combines digital sovereignty and cyber resilience.

Home>

Banks & FinTech

Fortify Your Digital Defenses With Myra

4 key areas – 1 outstanding technology

Security

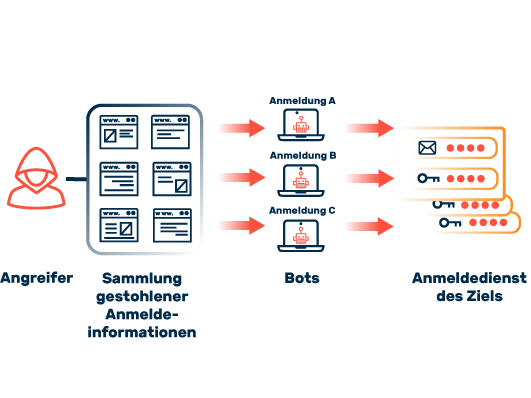

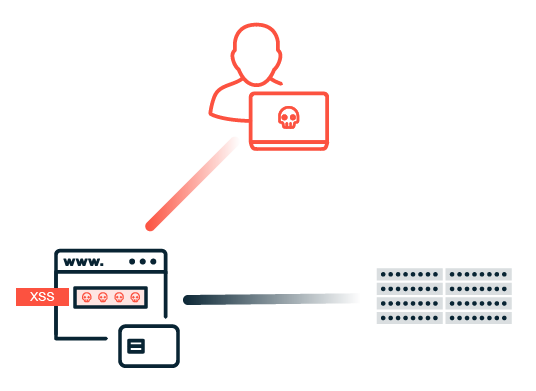

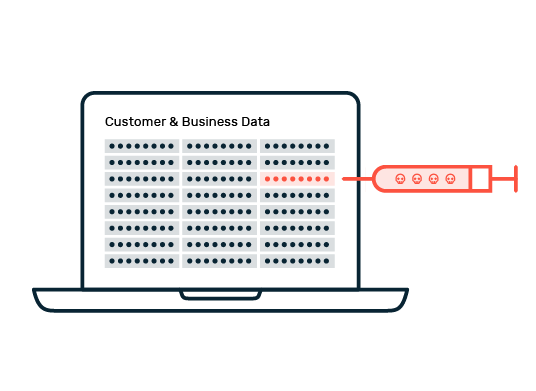

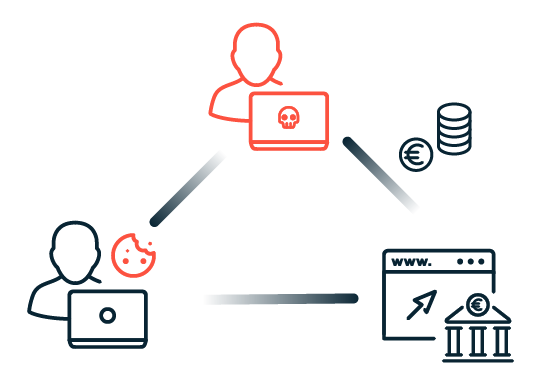

Avoid data theft, system outages, and disrupted communications. Our robust defense system protects your critical processes with unwavering vigilance.

Performance

Experience high-performance delivery of your content, even during traffic peaks. Maintain optimal performance and provide your users with a seamless experience.

Business Continuity

Myra ensures the utmost protection for your business by utilizing direct and geo-redundant connections to your infrastructure, without relying on external factors.

Compliance

Meet the requirements of IT security and data protection teams with ease. Myra is your trusted partner, offering unrivaled expertise in the strictest compliance regimes.

Designed and engineered for highly regulated sectors

Certified Security from Myra: Compliance Without Compromise

ISO 27001 on the basis of IT-Grundschutz (BSI)

Payment Card Industry Data Security Standard (PCI DSS)

BSI C5 Type 2

KRITIS Proof according to § 8a para. 3 BSIG

Trusted Cloud Service

IDW PS 951 Type 2 (ISAE 3402)

VS-NfD

Do you have

questions?

Please contact us via contact form or call us at:

+49 89 414141 - 345.

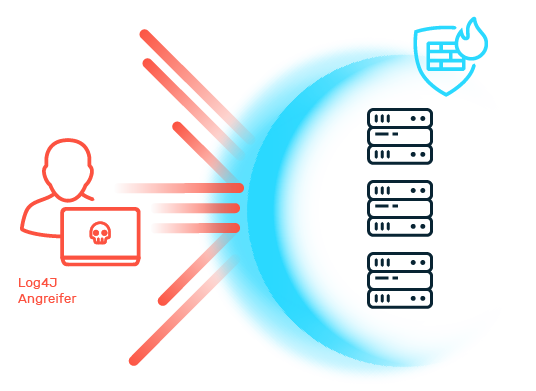

Protect Your Digital Assets from Malicious Web Traffic

FAQ: Financial Sector and IT Security

DORA (Digital Operational Resilience Act) and NIS-2 (Network and Information Security 2) are two important EU regulations designed to strengthen cybersecurity in the financial sector and other critical infrastructures. DORA aims to ensure the operational resilience of digital systems in the financial sector. It ensures that financial institutions remain operational and financial services remain available even in the event of cyberattacks. NIS-2 harmonizes cybersecurity requirements for critical infrastructure and essential services in the EU. It places particular emphasis on risk management and the reporting of security incidents.